Uncovering the secrets of reading crypto charts is an essential skill for savvy investors navigating the dynamic world of digital currencies. This guide delves into how to read crypto charts, giving you the knowledge you need to make informed investment decisions.

Table of Contents

- Understanding the Basics

- Reading Crypto Charts Like a Pro

- Advanced Chart Patterns

- Practical Tips for Effective Analysis

- Putting Knowledge into Practice

- Conclusion

- FAQs

- What are crypto charts, and why are they important for investors?

- How do different types of crypto charts, such as line charts and candlestick charts, differ in their presentation?

- What are some key technical indicators, and how do they help in crypto chart analysis?

- Can you explain the significance of chart patterns like head and shoulders, double top, and double bottom in crypto analysis?

- What practical tips can enhance the effectiveness of crypto chart analysis for investors?

Understanding the Basics

What Are Crypto Charts?

Crypto charts serve as visual depictions of a cryptocurrency’s historical price movements. Acting as a pivotal tool for investors, these charts offer a comprehensive record of price changes, enabling users to analyze past trends and make informed predictions of market direction. By studying these visual representations, investors can gain valuable insights into the dynamic nature of cryptocurrency prices.

Types of Crypto Charts

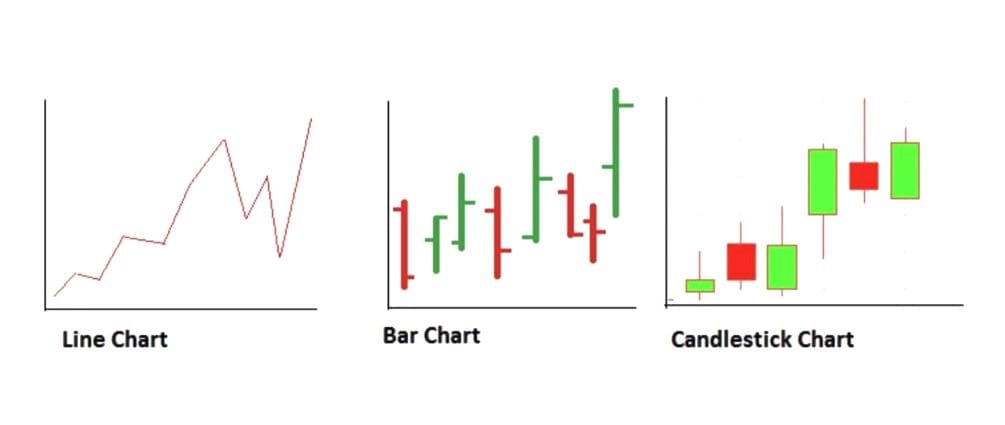

Line Charts: Functioning as a straightforward yet potent analytical tool, line charts connect closing prices over a specified timeframe, providing a rapid overview of trends. Investors often use these charts to identify general price movements and make quick assessments.

Candlestick Charts: Widely adopted in crypto analysis, candlestick charts present the opening, closing, high, and low prices within a specific time frame. The distinct candlestick shapes offer a nuanced understanding of market sentiment, aiding investors in making strategic decisions based on price patterns.

Bar Charts: Serving as an alternative visual representation to candlestick charts, bar charts condense the same information into a more compact format. This condensed view facilitates a quick grasp of price fluctuations over time, aiding in efficient analysis for seasoned investors.

Reading Crypto Charts Like a Pro

Identifying Trends

Successful crypto chart analysis hinges on mastering trend identification. Bullish trends, marked by rising prices, indicate positive market sentiment, while bearish trends, characterized by falling prices, signify a pessimistic market outlook. Recognizing and understanding these trends is essential for making well-informed investment decisions.

Key Technical Indicators

Moving Averages: By utilizing the average closing prices over a specific period, moving averages help smooth out price fluctuations. This aids in trend identification, allowing investors to discern overarching patterns in the market.

Relative Strength Index (RSI): RSI measures the magnitude of recent price changes, offering insights into overbought or oversold conditions. Investors use RSI to gauge the potential for price reversals, contributing to strategic decision-making.

Bollinger Bands: These bands aid in identifying volatility and potential trend reversals by plotting standard deviations around a moving average. Investors rely on Bollinger Bands to anticipate market fluctuations and adjust their strategies accordingly.

Advanced Chart Patterns

Head and Shoulders: Recognizing the head and shoulders pattern is paramount for predicting trend reversals. This distinctive pattern, characterized by three peaks (a higher peak between two lower peaks), signifies potential shifts in market sentiment, alerting investors to impending changes.

Double Top and Double Bottom: Identifying a double top or double bottom pattern signals potential trend reversals. A double top hints at an upcoming bearish trend, while a double bottom suggests a bullish reversal. Investors keen on pattern recognition leverage these indicators for strategic decision-making.

Practical Tips for Effective Analysis

Multiple Time Frame Analysis: Assessing charts across different time frames provides a holistic view of market trends. This approach allows investors to gain a comprehensive understanding of the cryptocurrency’s price movements, aiding in more informed decision-making.

Volume Analysis: Examining trading volumes alongside price movements offers valuable insights into the strength and sustainability of trends. Investors consider volume analysis as a key component in confirming the validity of identified trends.

News and Events Impact: Staying updated on relevant news and events is crucial, as these external factors can significantly influence crypto prices. Informed investors integrate current events into their analysis to anticipate potential market shifts and adjust their strategies accordingly.

Putting Knowledge into Practice

Now armed with the tools for reading crypto charts, investors can apply this knowledge to real-world scenarios. Regular practice, combined with staying informed about market developments, will serve to enhance chart analysis skills over time. This proactive approach positions investors to make strategic decisions with confidence in the ever-evolving landscape of cryptocurrency markets.

Conclusion

In conclusion, mastering the art of reading crypto charts is a fundamental step to becoming a successful cryptocurrency investor. Navigate the cryptocurrency market with confidence by understanding the nuances of different chart types, identifying key patterns, and using key technical indicators.

FAQs

What are crypto charts, and why are they important for investors?

Crypto charts are visual representations of a cryptocurrency’s price movements over time. They are crucial for investors as they provide a historical record of price changes, aiding in trend analysis and prediction of future market movements.

How do different types of crypto charts, such as line charts and candlestick charts, differ in their presentation?

Line charts offer a simple overview of trends by connecting closing prices, while candlestick charts display opening, closing, high, and low prices within a specific time frame. Understanding these differences is essential for effective chart analysis.

What are some key technical indicators, and how do they help in crypto chart analysis?

Moving averages, Relative Strength Index (RSI), and Bollinger Bands are key technical indicators. Moving averages smooth out price fluctuations, RSI measures recent price changes, and Bollinger Bands identifies volatility and potential trend reversals.

Can you explain the significance of chart patterns like head and shoulders, double top, and double bottom in crypto analysis?

The head and shoulders pattern signals potential trend reversals, with three peaks indicating shifts in market sentiment. Double-top and double-bottom patterns suggest impending trend reversals, providing valuable insights for investors.

What practical tips can enhance the effectiveness of crypto chart analysis for investors?

Multiple time frame analysis, volume analysis, and staying informed about relevant news and events are practical tips. Assessing charts across different time frames, examining trading volumes, and considering external factors contribute to more informed decision-making in the crypto market.